Some Ideas on Lamina Loans You Need To Know

Not known Incorrect Statements About Lamina Loans

Table of ContentsThe Basic Principles Of Lamina Loans Facts About Lamina Loans RevealedThe Main Principles Of Lamina Loans Not known Details About Lamina Loans What Does Lamina Loans Mean?Not known Incorrect Statements About Lamina Loans All about Lamina Loans

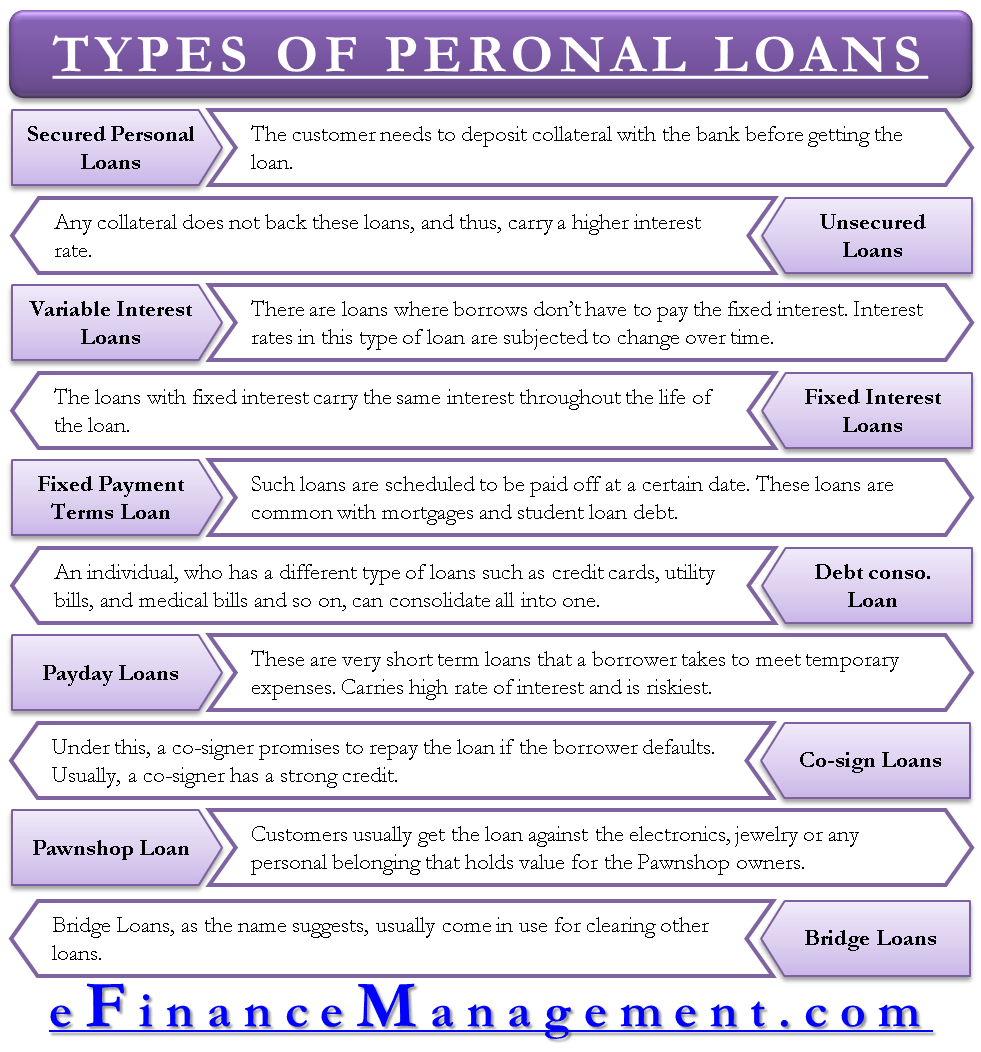

- This is a personal car loan with a set payment yet a changing rates of interest for the entire term of the car loan. If you intend to gain from those times when rate of interest are reduced, think about a financing with a variable rates of interest alternative. If prices go down, you can pay off your funding much faster.Allow's encounter it. You can not spend for whatever you desire all ahead of time. Certain, you could be able to pay for a made use of car with cash but you won't have the ability to acquire anything else for quite some time and also your funds will undoubtedly endure. That's where credit scores and lendings enter into the photo.

What Does Lamina Loans Mean?

Plus, there are financings available for almost anything you might ever before want to get in Canada. From vehicle car loans to mortgages and personal loans to charge card, Canadians are able to utilize the power of credit rating to pay for lots of various kinds of purchases in time. Allow's take a peek at some of the main types of financings in Canada and some of the loan products that are best prevented.

A credit report is a document of all the dealings you've had with lenders and also car loans for many years. It aids firms determine whether they'll extend you credit score and also, if they do, what your rate of interest will certainly be. Rates of interest are merely an estimation of riskthe even worse your credit rating, the greater your danger as well as the greater your rate of interest rate will likely be.

6 Easy Facts About Lamina Loans Shown

Simply put, there are various kinds of financings in Canada. There are lendings for nearly every possible kind of purchase from automobiles to products as well as services. There are typically two categories of lendings we'll be looking at: closed and also open. A shut financing is one that funds a certain product like a home or vehicle.

Guaranteed car loans are backed by a certain thing, called security. Your vehicle finance, for example, is secured since if you stop working to pay, your lending institution will certainly retrieve the vehicle - Lamina Loans. Your debt card, however, is unsecured because there is no item backing your credit history.

The Facts About Lamina Loans Uncovered

A residence equity lending servicer could give you with a line of credit rating based upon a percent of your current equity. Many loan providers won't provide you greater than 85% of the equity you have in your home as component of one of these fundings, but the quantity you can obtain will differ from bank to financial institution.

Automobile car loans are secured, closed-end finances that help you fund the cost of a new or used cars and truck. Interest prices on these loans can vary extensively based on the worth of the vehicle, the size of the lending, and also your creditworthiness. New cars and trucks tend to have lower prices than older cars since they are better.

Either way, be sure to go shopping about for the finest rate and also borrowing terms prior to you sign up for an auto lending in Canada. Credit rating cards are a type of flexible line of credit score, as well as they can be either protected or unsecured.

6 Simple Techniques For Lamina Loans

Not excellent. Personal car loans are closed-end, unsafe lines of credit that are utilized for a selection of different objectives. Whether it's construction on your residence or funding a holiday, personal loans can usually be made use of to finance your acquisitions (yet confirm any kind of spending limitations from your lending institution before you apply).

Rate of interest can likewise be really high up on personal fundings, specifically if you don't have excellent credit rating. If you're thinking about an individual lending, you ought to always strongly take into consideration whether you actually need to borrow money for your purchase. If you need from this source the cash for something essential, such as house repair services, as well as you can manage to repay the loan, it may be a worthwhile option.

You'll be liable for paying off your acquisition over time (generally in 4 to 5 installations). Many of these loans have no rate of interest if you pay them back on schedule but they may charge late payment and other similar fees. While there isn't typically an interest price linked with this sort of financing item, Visit Your URL you will likely still have your credit rating checked when you sign up for this sort of solution.

How Lamina Loans can Save You Time, Stress, and Money.

There are as several kinds of funding instruments in Canada as there are items to finance with them, as an example, Loans Canada is contrast platform that will aid you discover the very best price. If you opt to obtain a lending, make certain to do your research to make sure that you understand what you're signing up for.

As the name suggests, federal trainee car loans are provided by the federal government. They're part of the Department of Education and learning's William D. Ford Federal Direct Finance Program. Federal trainee loans are damaged down into 4 classifications: Direct Subsidized Loans, Straight Unsubsidized Loans, Direct PLUS Loans and also Direct Consolidation Financings. Within those categories, there are lending choices for undergraduate trainees, graduate pupils, professional trainees and also also parents.

Rate of interest prices on government pupil car loans are established each springtime by the federal government and are all taken care of. Federal pupil car loan rate of interest aren't based on the credit report of specific borrowers, and they remain the very same throughout the lending. Here's exactly how each sort of government financing works: Direct subsidized finances are available to undergraduate students of a college or profession institution who demonstrate monetary demand.

Some Known Facts About Lamina Loans.

Due to the fact that subsidized student loans are based upon need, they commonly have better terms than various other kinds my site of finances. Lamina Loans. The federal government will pay for the rate of interest on subsidized lendings as long as the consumer is registered in college at least half the time. It will certainly also cover passion payments for 6 months after graduationknown as a poise duration.

Borrowers, not the federal government, are normally responsible for paying rate of interest that accumulates throughout school, grace durations and also deferments. This remains in part since of a procedure called capitalization. Although borrowers are accountable for paying rate of interest, the price undergrads pay for unsubsidized car loans is the very same as the price for subsidized lendings.